Gift Tax Property Transfer Child . The property will only become chargeable. gifting a property to your adult children is a relatively complex transaction but it can have a number of benefits. In this article, we outline: what is considered a gift? May i deduct gifts on my income tax return?. when you give anyone other than your spouse property valued at more than $18,000 ($36,000 per couple) in any. the gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less. What can be excluded from gifts? if the child is over 18, you can simply transfer the property to the children. we explain the complicated tax rules around gifting property so you can decide if it works for you.

from www.pgpf.org

if the child is over 18, you can simply transfer the property to the children. In this article, we outline: gifting a property to your adult children is a relatively complex transaction but it can have a number of benefits. May i deduct gifts on my income tax return?. the gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less. when you give anyone other than your spouse property valued at more than $18,000 ($36,000 per couple) in any. we explain the complicated tax rules around gifting property so you can decide if it works for you. The property will only become chargeable. what is considered a gift? What can be excluded from gifts?

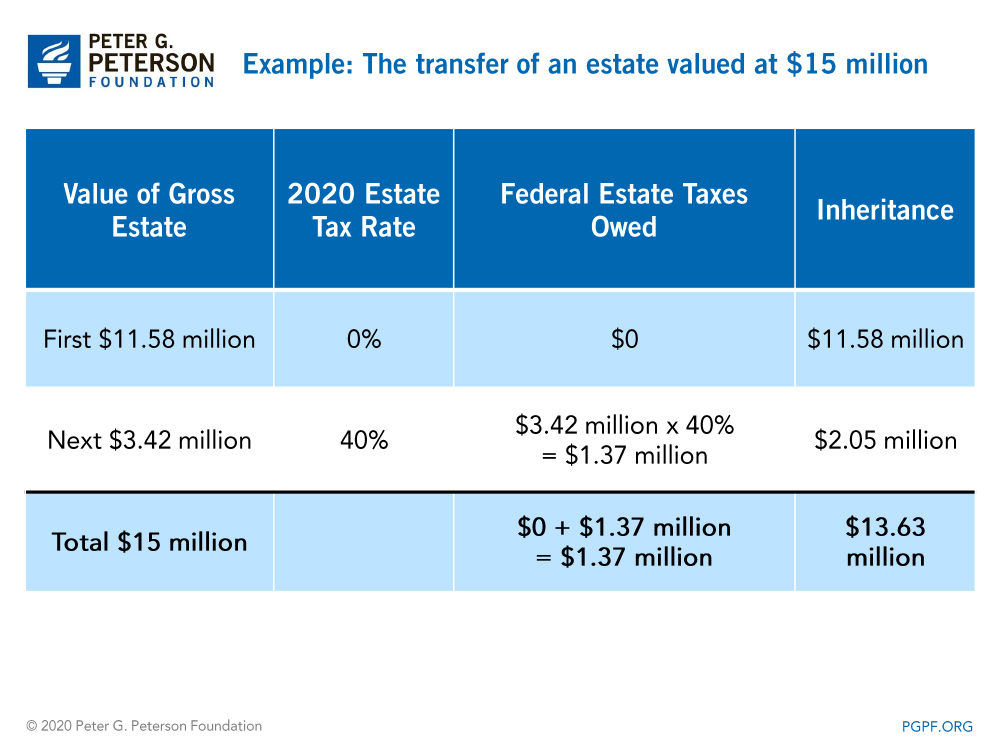

What Are Estate and Gift Taxes and How Do They Work?

Gift Tax Property Transfer Child what is considered a gift? gifting a property to your adult children is a relatively complex transaction but it can have a number of benefits. if the child is over 18, you can simply transfer the property to the children. The property will only become chargeable. the gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less. what is considered a gift? May i deduct gifts on my income tax return?. we explain the complicated tax rules around gifting property so you can decide if it works for you. In this article, we outline: What can be excluded from gifts? when you give anyone other than your spouse property valued at more than $18,000 ($36,000 per couple) in any.

From www.itrtoday.com

The rules for Taxability of Gift under various Scenario scenarios to be Gift Tax Property Transfer Child The property will only become chargeable. May i deduct gifts on my income tax return?. what is considered a gift? gifting a property to your adult children is a relatively complex transaction but it can have a number of benefits. In this article, we outline: we explain the complicated tax rules around gifting property so you can. Gift Tax Property Transfer Child.

From www.marinerwealthadvisors.com

Estate and Gift Tax Quick Facts Mariner Wealth Advisors Gift Tax Property Transfer Child what is considered a gift? the gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less. May i deduct gifts on my income tax return?. if the child is over 18, you can simply transfer the property to the children. when you give anyone other than. Gift Tax Property Transfer Child.

From cloanc.com

Proposition 58 Parent To Child Transfer of Property Tax Rate Gift Tax Property Transfer Child What can be excluded from gifts? The property will only become chargeable. gifting a property to your adult children is a relatively complex transaction but it can have a number of benefits. what is considered a gift? May i deduct gifts on my income tax return?. we explain the complicated tax rules around gifting property so you. Gift Tax Property Transfer Child.

From www.sampleforms.com

FREE 10+ Property Transfer Forms in PDF Ms Word Excel Gift Tax Property Transfer Child what is considered a gift? if the child is over 18, you can simply transfer the property to the children. In this article, we outline: May i deduct gifts on my income tax return?. What can be excluded from gifts? the gift tax is a tax on the transfer of property by one individual to another while. Gift Tax Property Transfer Child.

From www.slideserve.com

PPT Overview of Estate/Gift Tax Unified Rate Schedule PowerPoint Gift Tax Property Transfer Child In this article, we outline: What can be excluded from gifts? May i deduct gifts on my income tax return?. what is considered a gift? we explain the complicated tax rules around gifting property so you can decide if it works for you. if the child is over 18, you can simply transfer the property to the. Gift Tax Property Transfer Child.

From childhealthpolicy.vumc.org

💄 Transfer of property through will. Gift Deed Can I transfer my house Gift Tax Property Transfer Child May i deduct gifts on my income tax return?. The property will only become chargeable. if the child is over 18, you can simply transfer the property to the children. we explain the complicated tax rules around gifting property so you can decide if it works for you. In this article, we outline: when you give anyone. Gift Tax Property Transfer Child.

From www.financestrategists.com

Lifetime Gift Tax Exemption Definition, Amounts, & Impact Gift Tax Property Transfer Child when you give anyone other than your spouse property valued at more than $18,000 ($36,000 per couple) in any. we explain the complicated tax rules around gifting property so you can decide if it works for you. what is considered a gift? What can be excluded from gifts? the gift tax is a tax on the. Gift Tax Property Transfer Child.

From my-unit-property-9.netlify.app

Property Gift Deed Format Father To Son Gift Tax Property Transfer Child when you give anyone other than your spouse property valued at more than $18,000 ($36,000 per couple) in any. we explain the complicated tax rules around gifting property so you can decide if it works for you. gifting a property to your adult children is a relatively complex transaction but it can have a number of benefits.. Gift Tax Property Transfer Child.

From www.sprouselaw.com

A Guide for Understanding the U.S. Federal Gift Tax Rules Sprouse Gift Tax Property Transfer Child we explain the complicated tax rules around gifting property so you can decide if it works for you. May i deduct gifts on my income tax return?. what is considered a gift? if the child is over 18, you can simply transfer the property to the children. What can be excluded from gifts? The property will only. Gift Tax Property Transfer Child.

From kenmei.edu.vn

Aggregate more than 150 parents gifting property to child latest Gift Tax Property Transfer Child what is considered a gift? gifting a property to your adult children is a relatively complex transaction but it can have a number of benefits. May i deduct gifts on my income tax return?. What can be excluded from gifts? when you give anyone other than your spouse property valued at more than $18,000 ($36,000 per couple). Gift Tax Property Transfer Child.

From www.pgnpropertymanagement.in

What is the process of transferring property through gift deed where Gift Tax Property Transfer Child what is considered a gift? we explain the complicated tax rules around gifting property so you can decide if it works for you. In this article, we outline: The property will only become chargeable. the gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less. What can. Gift Tax Property Transfer Child.

From www.slideteam.net

Paying Gift Tax Property In Powerpoint And Google Slides Cpb Gift Tax Property Transfer Child if the child is over 18, you can simply transfer the property to the children. In this article, we outline: The property will only become chargeable. May i deduct gifts on my income tax return?. gifting a property to your adult children is a relatively complex transaction but it can have a number of benefits. what is. Gift Tax Property Transfer Child.

From htj.tax

US Gift & Estate Taxes 2022 Gifts, Transfer Taxes HTJ Tax Gift Tax Property Transfer Child May i deduct gifts on my income tax return?. when you give anyone other than your spouse property valued at more than $18,000 ($36,000 per couple) in any. what is considered a gift? if the child is over 18, you can simply transfer the property to the children. In this article, we outline: What can be excluded. Gift Tax Property Transfer Child.

From www.gmlaw.com.au

How To Transfer Property Between Family Members in Queensland GM Law Gift Tax Property Transfer Child gifting a property to your adult children is a relatively complex transaction but it can have a number of benefits. What can be excluded from gifts? what is considered a gift? if the child is over 18, you can simply transfer the property to the children. In this article, we outline: the gift tax is a. Gift Tax Property Transfer Child.

From buytolettaxaccountants.co.uk

Transferring property into a trust as a gift or to children. Tax Gift Tax Property Transfer Child What can be excluded from gifts? In this article, we outline: May i deduct gifts on my income tax return?. what is considered a gift? The property will only become chargeable. gifting a property to your adult children is a relatively complex transaction but it can have a number of benefits. the gift tax is a tax. Gift Tax Property Transfer Child.

From centsai.com

What is the Gift Tax and How Does It Work? I CentSai Gift Tax Property Transfer Child The property will only become chargeable. we explain the complicated tax rules around gifting property so you can decide if it works for you. when you give anyone other than your spouse property valued at more than $18,000 ($36,000 per couple) in any. In this article, we outline: gifting a property to your adult children is a. Gift Tax Property Transfer Child.

From cloanc.com

Parent to Child Property Tax Transfer Commercial Loan Corp, Provider Gift Tax Property Transfer Child if the child is over 18, you can simply transfer the property to the children. when you give anyone other than your spouse property valued at more than $18,000 ($36,000 per couple) in any. In this article, we outline: The property will only become chargeable. we explain the complicated tax rules around gifting property so you can. Gift Tax Property Transfer Child.

From www.cnb.com

What Is the Gift Tax? City National Bank Gift Tax Property Transfer Child May i deduct gifts on my income tax return?. what is considered a gift? gifting a property to your adult children is a relatively complex transaction but it can have a number of benefits. The property will only become chargeable. In this article, we outline: if the child is over 18, you can simply transfer the property. Gift Tax Property Transfer Child.